A Smart Solution for All Kinds of Industries.

Freelancers, CA, HR Professionals, Lawyers, Artists etc

Get paid instantly via 100+ payment methods & track all payments in one dashboard. Improve your payment cycle with automatic payment reminders

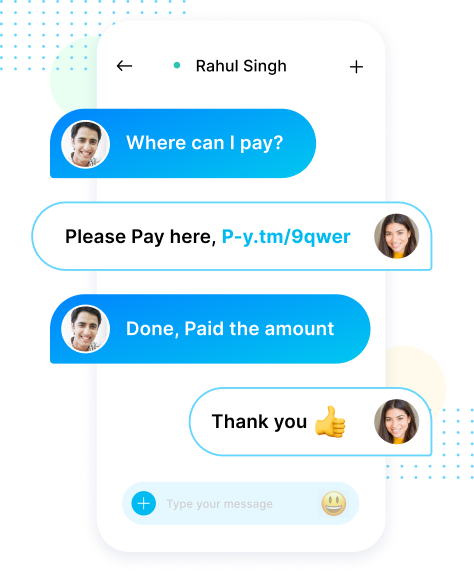

Direct to Customer & Social Media Businesses

Manage payments for your business on WhatsApp, Instagram or Facebook without creation of any website on one dashboard. Payment Link is all that you need !

Education

Create bulk payment links & give parents the flexibility of paying through payment method of their choice

Retail Merchants

Convert your home delivery COD orders to Prepaid & delight your customers with the flexibility of payment methods

E-Commerce Businesses

Reduce RTO on COD Orders & target customers who have abandoned their carts using Payment Links

Wholesalers & Distributors

Collect payments from retailers, vendors etc at the click of a button

IT Services

Send a payment link for advance token amount collection or at the time of project completion & accelerate your payment cycle

Home Cooks/Bakers

Let people across India enjoy the taste of your food. Just close the order on phone/chat, send a Paytm Payment Link to receive the payment & you are done

Travel Business (Adventure Sports etc)

Plan your business better by collecting digital payments from your enquiries and reduce the No-Show

Home Design Businesses

Accelerate the delivery of projects and reduce delays due to payment waiting period. Create payment links in advance with payment reminders & partial Payments.

Online Medicine & Healthtech

Give your patients the convenience of online consultation & home delivery of medicines or collection of blood samples along with the choice of payment modes. Delighted customers are just a link away now.

BFSI, NBC & Lending Companies

Reduce missed payments with payment links & automatic payment reminders for Loan/EMI Repayments

Utility Service Businesses

Reduce missed payments from customers by sending them payment links in advance & enable automatic payment reminders

Logistics

Now ensure the delivery in the first attempt even if the receiver isn’t available. Convert COD orders to Paid orders just by sending a payment link.

Partner Payments

Manage collection of commission from your resellers/partners efficiently using a payment link & automatic payment reminders

ERP

Say Bye to reconciliation hassles by creating a payment link directly from your ERP. Focus on your core business & leave the payment & reconciliation hassles to Paytm Payment Links

Ed-Tech

Close your deals instantly. Send payment links to students/parents and offer them the affordability of No cost EMI and 100+ payment sources to choose from.