Scalable decision engine that dynamically manages risk, prevents fraud and grows your business

Pi is designed for efficiency and scale

Faster decision-making than the industry average1

Average maintained approval rating2

Rule evaluations every day3

Decisions made every day3

How Pi works

A smart, scalable decision engine that identifies risk profiles from your entire ecosystem, helps prevent every major type of fraud and enables business growth.

Why Pi is a powerful fraud fighting machine

No code. Easy to use templates

Leverage easy-to-use industry templates to dynamically manage activity and pin-point anomalies across your ecosystem.

Experiment, analyze and deploy AI/ML models

Pi takes guesswork out of the equation by letting you test rules in a simulated environment so you can anticipate changes and see results before publishing.

Comprehensive data ingestion.

Pi securely leverages your proprietary and third-party data aggregating all of it into one comprehensive view of your entire business’ ecosystem.

Lightning-fast, no latency

Pi offers an in-built anomaly detection to automatically identify, detect patterns and outliers, sending you real time alerts of activity shifts in your ecosystem.

Prevent every type of fraud

Pi offers solutions to prevent account takeovers, promotion frauds and transaction frauds all while creating the least amount of user friction.

Reduce false declines

Stop threats as they emerge with Pi’s machine learning based fraud detection models with a feedback loop that improves accuracy and minimizes false positives.

One fraud solution for your entire team

Pi is not only effective, it's intuitive and has use-cases for every stakeholder

- Leaders

- Managers

- Operators

For CEOs, CTOs, CIOs, and Chief Risk Officers

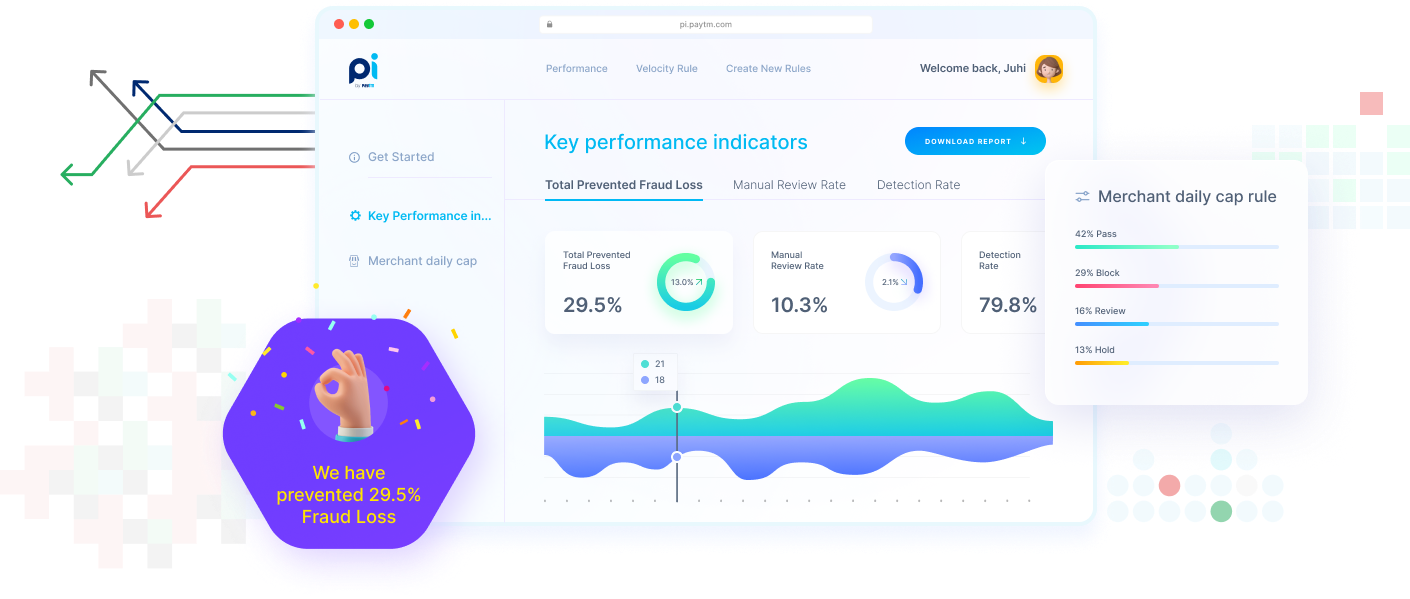

- Grow your bottom line with smarter risk decisioning

- Deploy ML to shift defenses dynamically

- Offer right friction to the right users at the right time

- Profit from detailed reports and analytics

- Monitor industry trends

- Optimize controls, processes, and auditing

For Heads of Risk, Risk Managers, and Directors of Risk

- Auto-adjust risk tiering, rules, and thresholds with ML

- Implement within 3-4 weeks

- Execute rules at speeds of 50ms

- Shadow test rules before pushing live

- Craft reusable variable blocks to easily plug into rules

- Deploy smarter anomaly and pattern recognition

For Risk Strategists, Risk Analysts, and Risk Engineers

- Utilize case management to fast track responses to flagged activity

- Modify rules in minutes (no coding required)

- Boost efficiency with auto-decisioning and bulk actions

- Stay informed with real time alerts, data-rich reports, and a comprehensive audit trail

Complete anti-fraud solution for every major threat

Prevent Account Takeover

Pi’s Account Shield uses a multi-layered approach to stop takeovers before they start, so your customers and revenue are better protected.

Prevent Promotion Abuse

Eliminate offer misuse and ensure the right customers get the right promos with Promo Protection from Pi.

Prevent Transaction Fraud

Secure sensitive payment data and create a payment environment that your customers trust.

Get Pi for your business today!

Write to us at pi@paytm.com