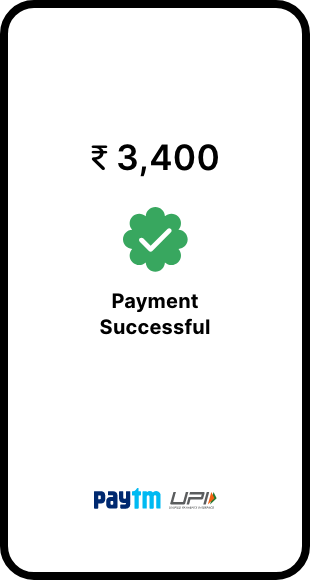

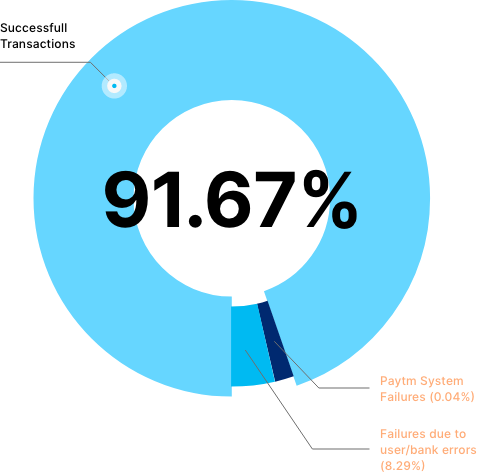

Best Success Rates

Experience best in class success rate for UPI using our hosted/API based solutions

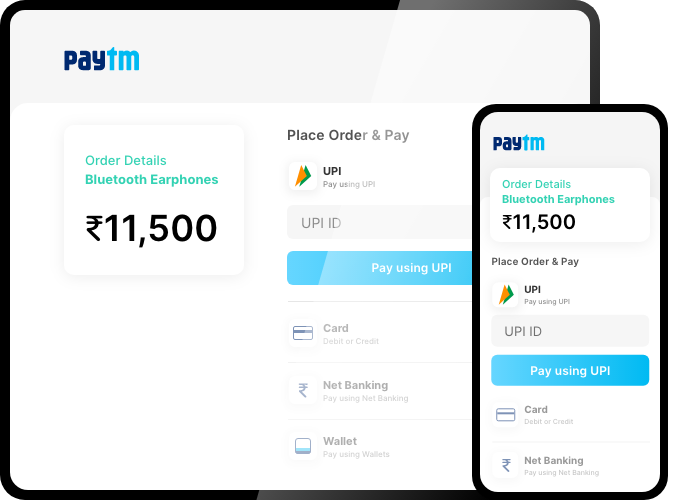

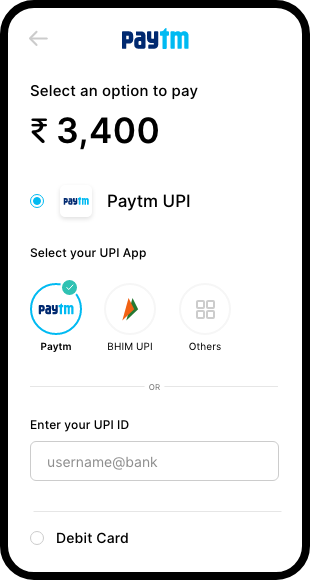

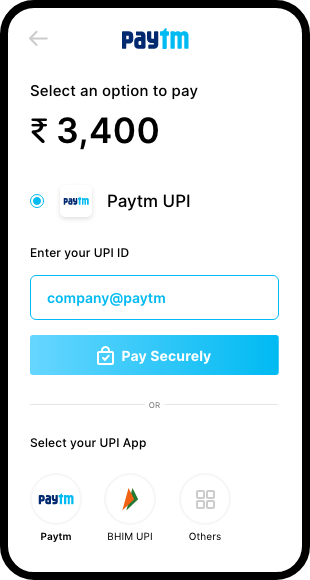

Enable Multiple UPI Methods

Customers can enter VPA or can choose their favourite UPI app to pay directly

Super Easy. Super Simple.

How to accept payments with UPI

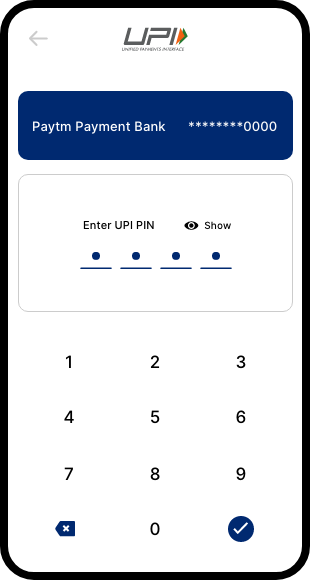

UPI Intent

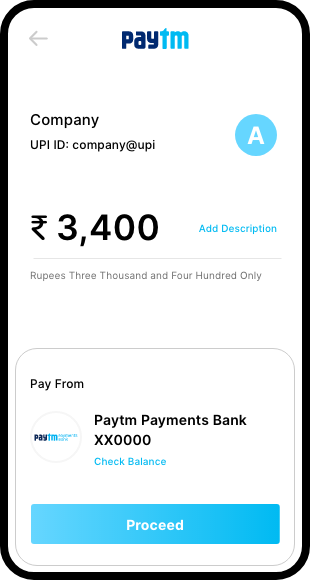

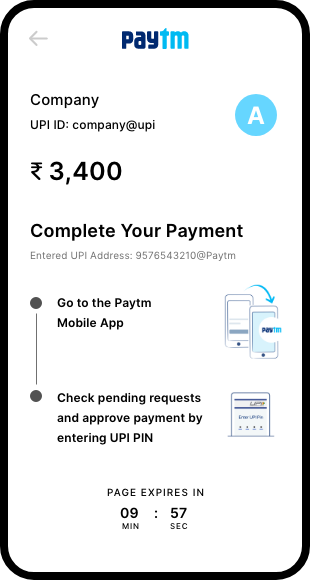

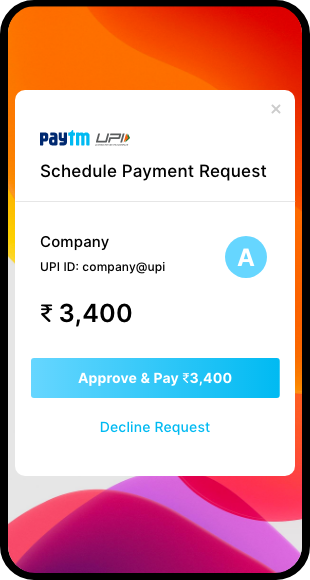

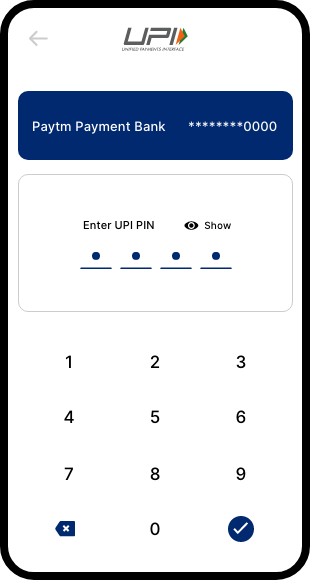

UPI Collect

Experience Paytm’sIncredible Success Rates

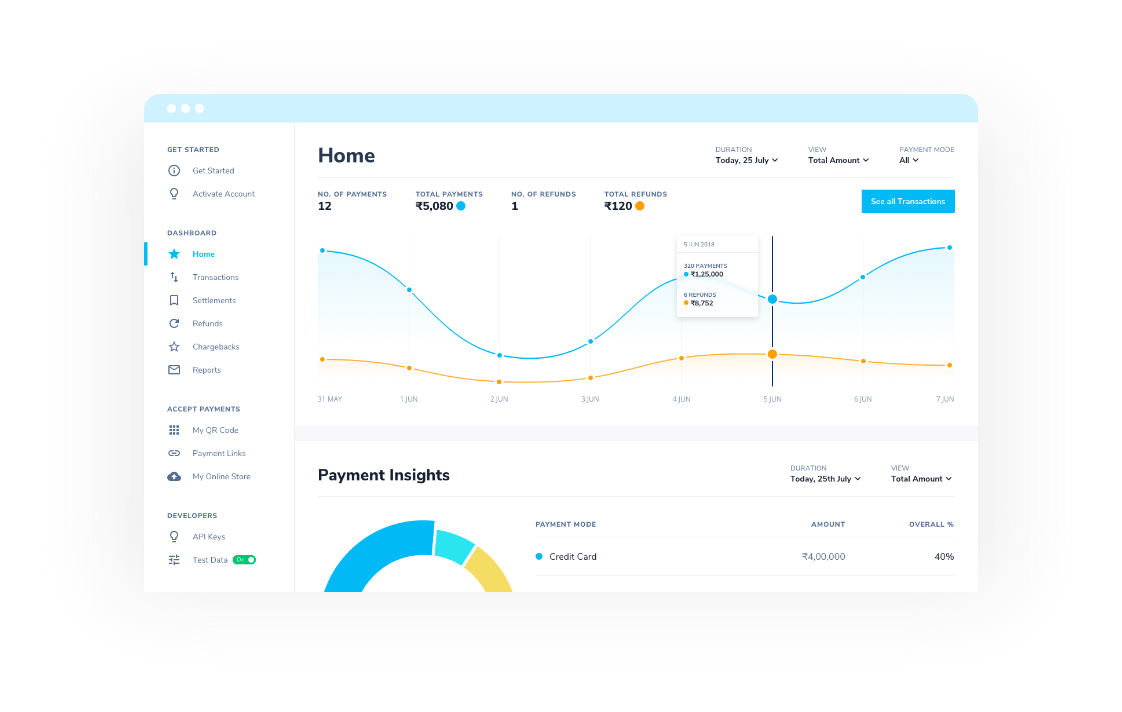

Business Growth Insights with a Powerful Dashboard

Manage your account

See payments, initiate refunds, download reports, view bank settlements & more

In-depth analytics

View metrics important for your business, see real-time reports & useful statistics